Najeeb Zaidi

Background

There is a need to bust the myth and anxiety around the buzz-word ‘Blockchain’. This applies to all and sundry because we are divorcing ourselves from its great potential to address the usurpation of our trust in the usual banking system and the way business has been done as usual to date. The administrative and general user groups in Pakistan are relatively behind the technology evolution curve and that is why the fear of blockchain. Presumably, there is also a small group of people who completely understand blockchain’s true potential and are either beneficiaries of maintaining a status quo or simply lack the initiative.

There is yet another segregation of those who side with the misnomer of blockchain being a tool only used by participants of undocumented/ illicit fund transfers.

So, let us simplify and try to understand what the blockchain is, how we can use it, why it has the potential to turn the world upside down and find the real value of this technology in the context of Pakistan’s operating environment. In the process we will attempt to see through the deeper levels of this technology but without the marketing jargon circulating on the web. Like every technology, that attempts to solve some real-life problem, blockchain is no different. It is a type of database or a ledger of records connected to all previous records in order of time as the data was generated.

How did it all start?

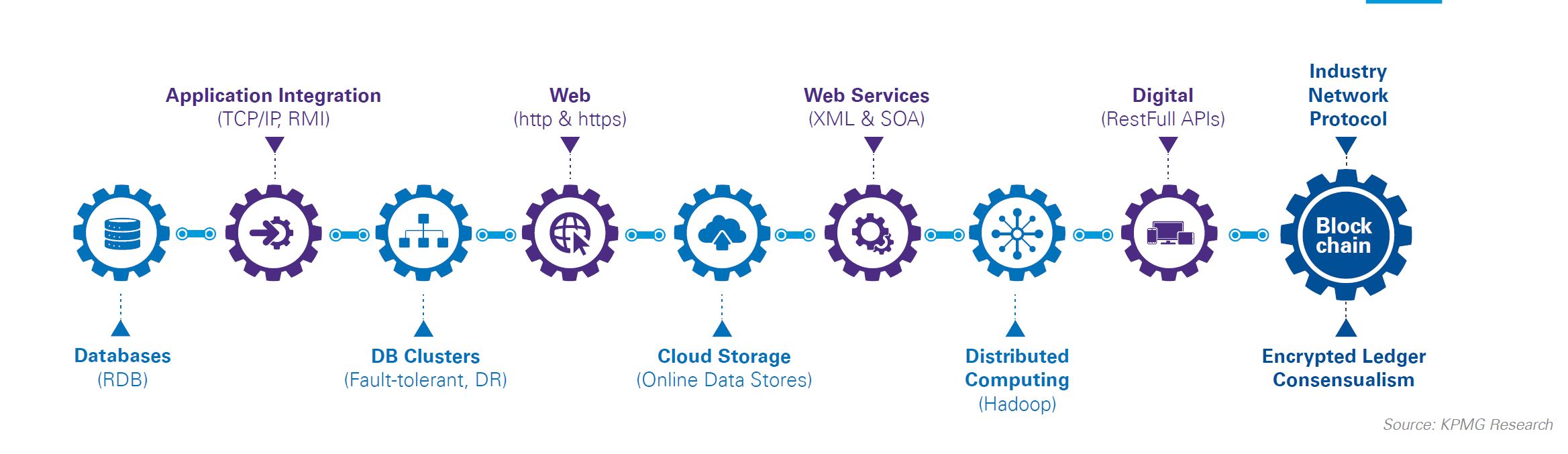

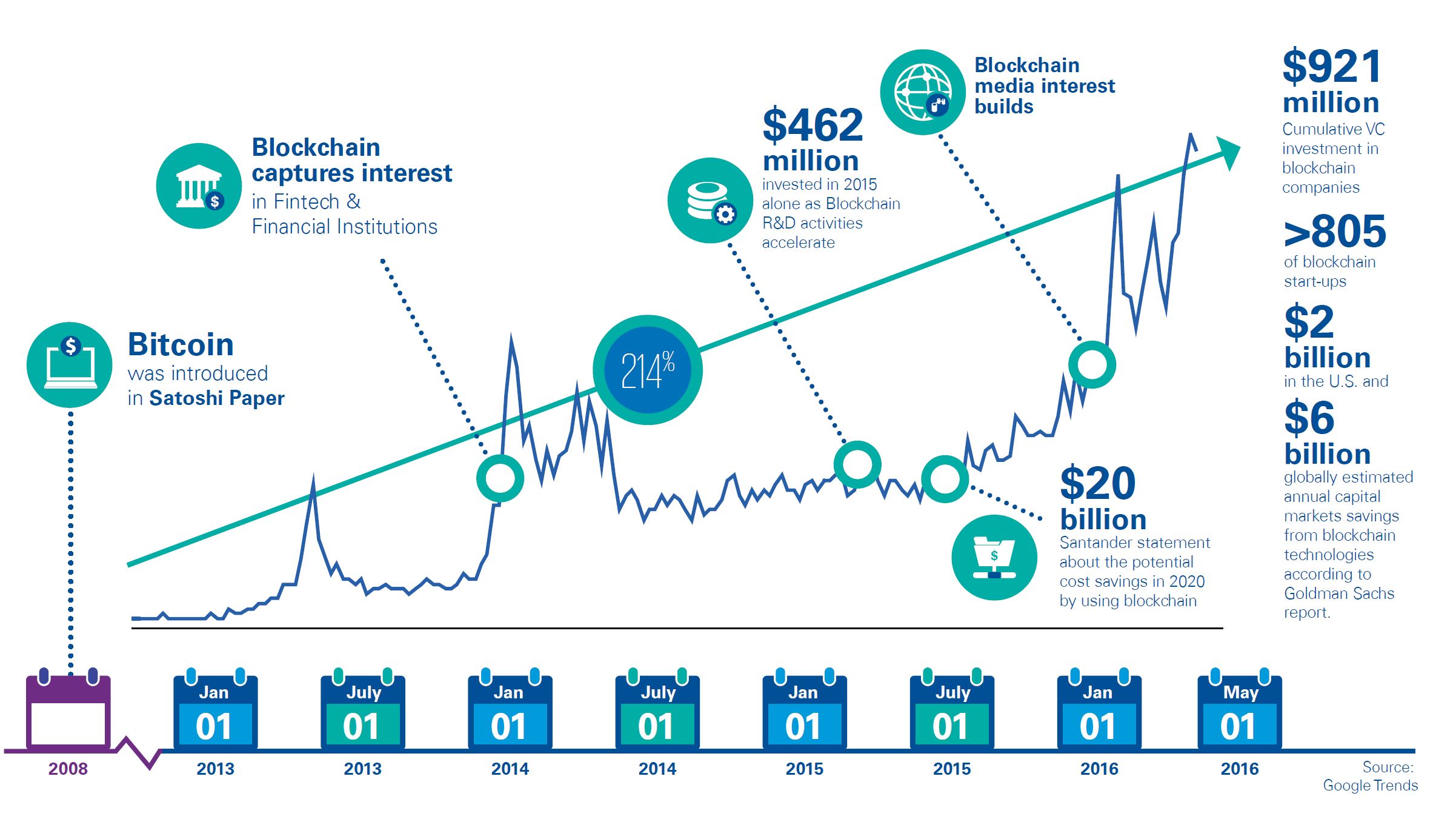

In 2008, in the wake of the world financial crisis, the general confidence on traditional financial systems had declined and someone using the name Satoshi Nakamoto found a new way to handle money and other kinds of data. It was a method that soon spread among computer scientists, privacy advocates, media theorists and banks – anyone who had wrestled with the question of how to establish trust among two parties on the internet. The underlying building blocks of this technology evolved since 1960s along with developments in computers, networking and digital information.

The so-called “Blockchain Revolution” that picked momentum sometime in 2014 is a transformational technology already changing the way we do business, banking, legal contracts and even own assets. It is synonymous to a transformation that took place when the automotive replaced the horse-cart on the road.

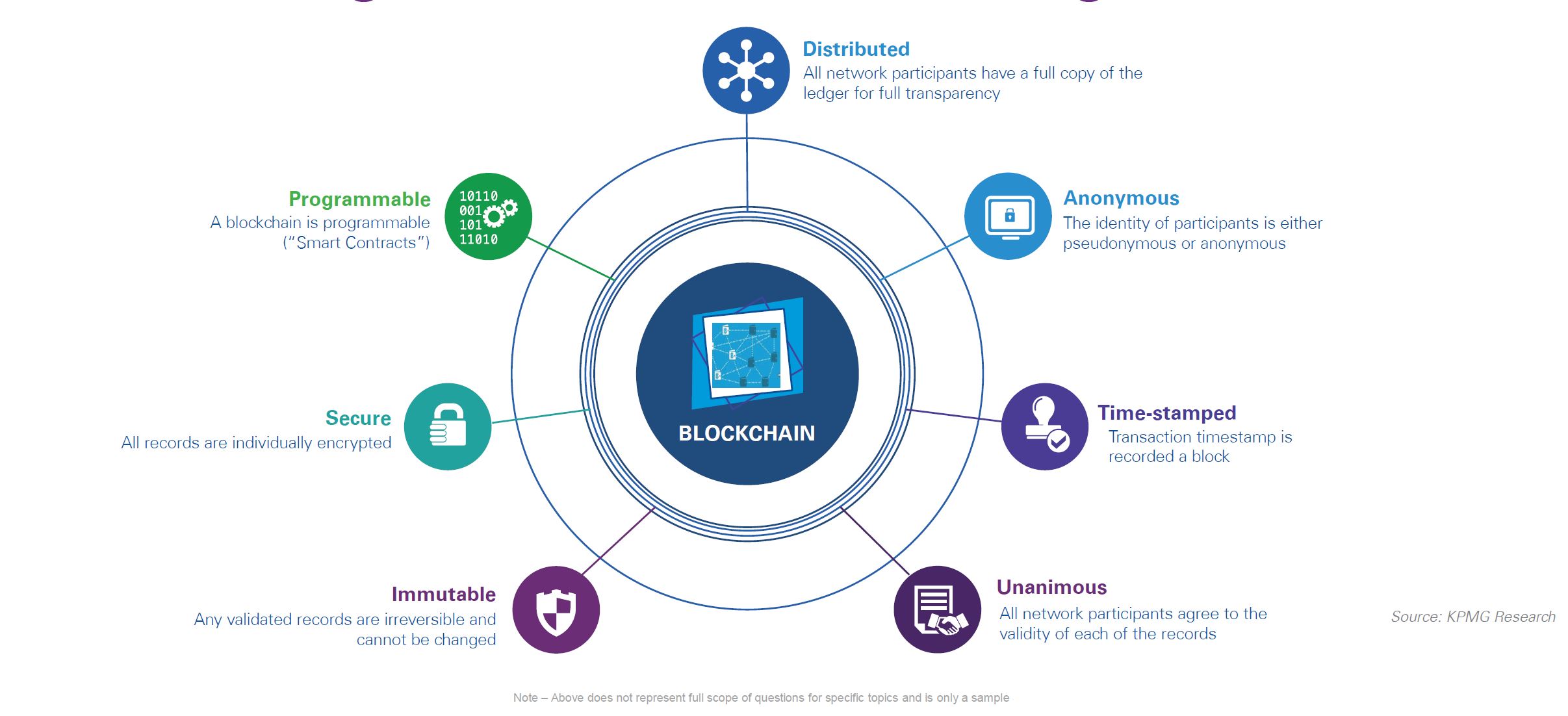

The originating technology behind Blockchain is called the Distributed Ledger Technology (DLT) while Blockchain is one of its applications and focuses to remove dependency and cost of intermediaries when two parties transact or exchange any item of value, which could be money, data, or something else. In other words, it ensures and automates trust and secured delivery between two parties. While doing so, it ensures that the information in transit is protected (or coded/ encrypted) so that no third party can change or intervene, it ensures the validity and authenticity on both sides, and ensures that the record of exchange and ownership cannot be changed post facto.

Thus, it has financial and non-financial applications. If utilized fully and appropriately, we could replace the costly and more often risky intermediaries or middlemen-entities, and therefore create transparent financial, legal, regulatory and communications systems free from the endless corruption and dark money that plagues the world. In Pakistan’s context, it becomes much more relevant as we wrangle through a legacy of inefficient, damaged and possibly compromised structures.

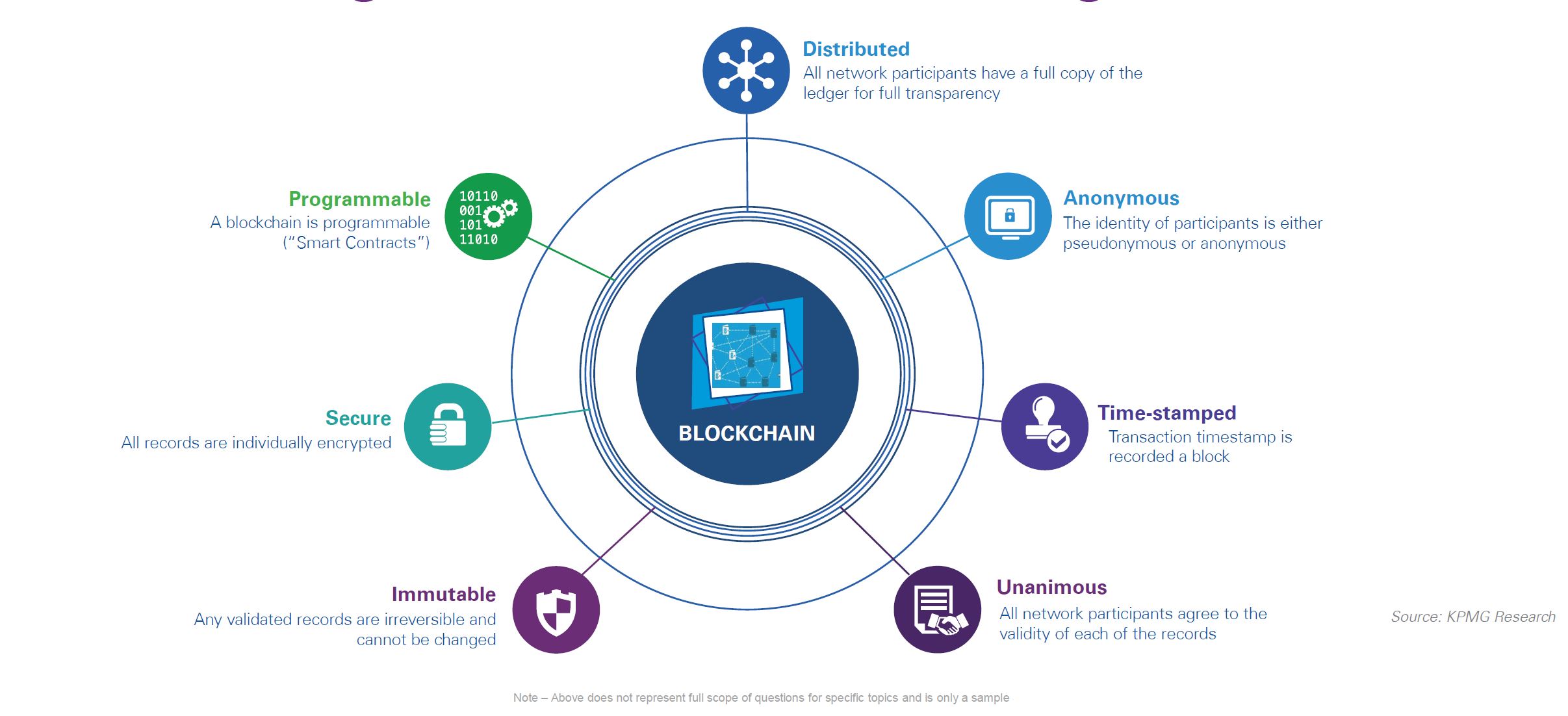

They had blocks of data or digital records. Since blockchain is a unique kind of a database or a ledger of records that are connected in a time-stamped sequence, and data in each block with other connecting blocks is all encrypted for protection, therefore the term blockchain. The architectural concept is well described by KPMG research poster on the subject shown in Fig-1.

Second the ledger is distributed across several servers such that it makes it very difficult and costly for any intruder to break the ledger and access all the pieces of information which is “distributed” across the network.

Thus, the encryption and distributed characters of this ledger ensure the security.

Third, the network is decentralized in such a way that no single party controls the ledger. In this way the validity and trustworthy characteristics of the database are achieved. Although there are many sub-types and permutations for specific applications, but for now it is important to understand that the terms named “decentralized” and “distributed” are not interchangeable and are ways, in addition to encryption, to secure the data and transactions in the blockchain system.

In summary, the five key characteristics that make Blockchains a transformative technology are Tamper-proof, Decentralized, Distributed, Validated, Authenticated.

How do we use it?

Let us take a real example to understand how this would work. If you are looking to buy a house, but the seller insists that no banks or notaries get involved. You would probably be suspicious about such a seller’s trustworthiness.

We currently rely on a municipal-patwari or housing-scheme office (intermediaries) that ensures the ownership records, transfer-name process etc, and a bank to ensure the payment transaction is legitimate, allowing both buyer and seller to feel comfortable, thus the process of validation and authentication. However, history shows us that middlemen themselves are not always the most trustworthy.

There are numerous cases of fake housing schemes and sellers of land, while banks can go bankrupt and lose your money by making bad deals. And with more and more cases of unwarranted mutation of records, surveillance, even governments can seem untrustworthy – and they’re certainly capable of going bankrupt themselves.

So where does the blockchain fit into all this? Well, until recently, most people would say that the internet lacked the proper security for big transactions involving money or property. But blockchain technology is already changing this conception by providing a confirmed, tamper-proof record of sale and exchange of money between the buyers and sellers thus bypassing traditional central authorities like banks and patwari records.

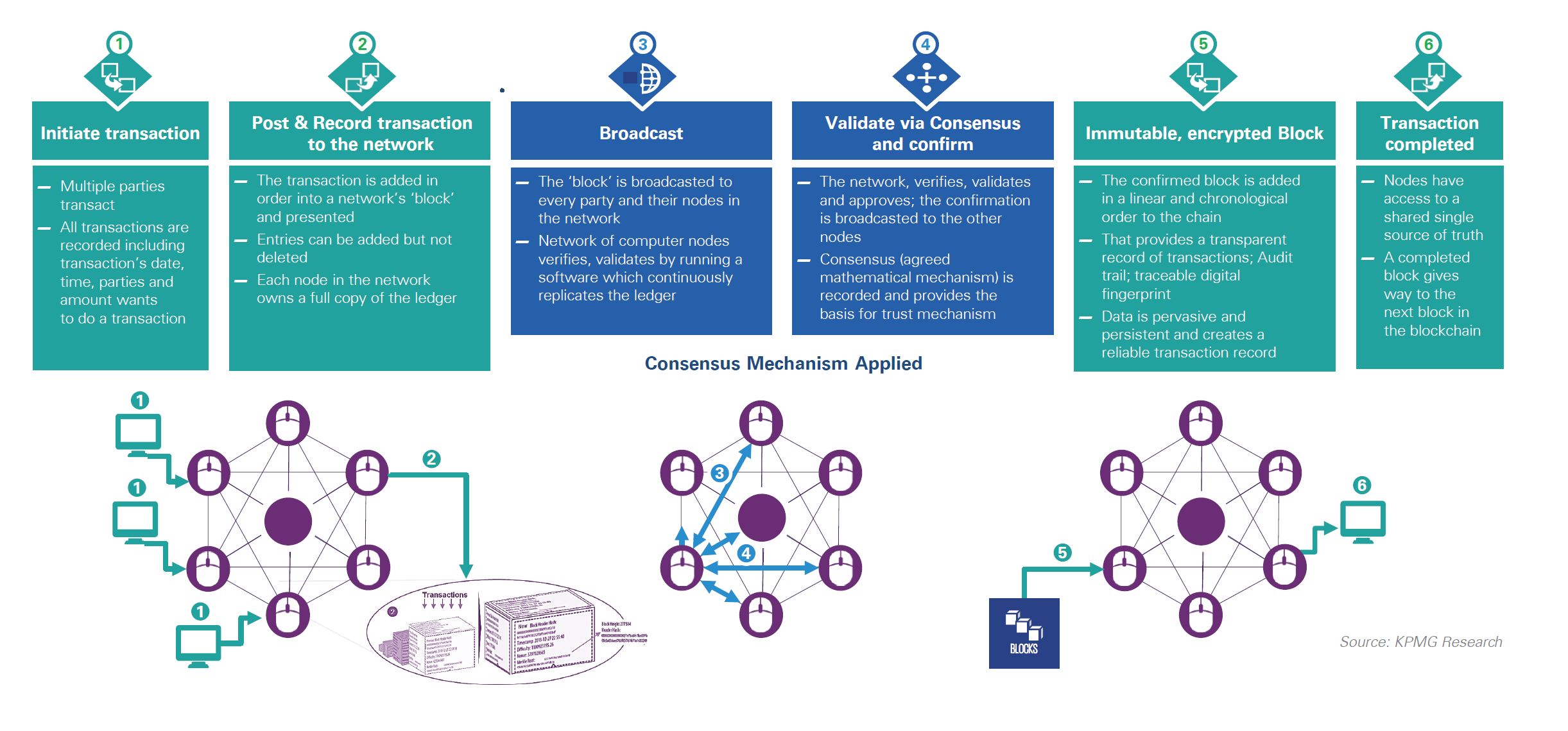

It does this by making every transaction a transparent process. Everyone using the blockchain has access to, and thus compose the management of, an incorruptible decentralized database. Fig-2 shows a sample process and its components for more tech savvy audiences. Credits to KPMG research.

When a transaction is made, it gets timestamped and added to the database, and rules defined, when it clearly doesn’t corrupt the system and is agreed upon by a consensus (of all parties involved, or other agreed formula), it gets legitimized or that “block” of transaction record becomes permanent part of the blockchain.

For simplicity, here we have not discussed the underlying algorithms and validations (or generally referred to as “mining”) processes that enable a successful transaction close but Fig-2 shows where they fit in the process. It is however clear by now how we can use the blockchain technology to reduce or even remove corruption and improve contract execution problems within our system.

With this level of transparency and verification protocol, there is no opportunity for hackers or thieves to make changes that will go unnoticed. Plus, the system doesn’t allow for changes to old entries. Since no single entity that controls the blockchain, everyone can trust it. Additionally, the blockchain makes the transaction and associated finances faster, cheaper and more inclusive than traditional banks.

Is this not a threat to banks and other government bodies?

Yes, it is a threat and an opportunity. This is the main reason why this technology is changing the business models for banks and all other entities that operate or benefit from a business of intermediation only.

International Banks saw this change evolving in 2012 and moved fast to change their business models. This transformation to utilize blockchain in banking and financial services is called Fin-tech or financial technology transformation. Similarly, the regulators and governments joining the band wagon through Reg-tech and Gov-tech. All those who decide not to change, will soon be out of business. I believe Pakistani bureaucratic and administrative circles have realized this lately however a reforms agenda cannot be complete without above inclusions.

What happens to the governments and banks controlling the financial flow and running their intermediation?

These will require to adopt new business models, operating structures and formulate new regulations.

This is probably the most important of the reasons, why every decision maker must understand the application intricacies of these new technologies since they disrupt the older rusty and inefficient processes. It is no more a topic for IT department to handle, unless they choose to retire early.

As of 2019, all G30 nations have introduced some form of Fin-tech, Reg-tech and Gov-tech regulations, or at least are in advanced stages of implementing such regulations along with underlying technologies. Highlight that these are far different from the ‘Digital policies and regulations’ that cover only the financial vs the telecom transaction operations, therefore not mixed or confused with the much broader Fin-tech regulations.

What are the Financial and Non-Financial Applications?

As we can see from the description above, the blockchain technology is integrated or built-in along the payment and transfer-of-value between two parties. Thus, any blockchain application, financial or non-financial will require a party that owns something in digital form (called the Digital Asset) and the other receiving counterparty would own something of value that the first party is willing to receive in exchange. So clearly, it is important to understand the real meaning of Digital Asset.

What is a Digital Asset?

Any item of value, which could be data, record of ownership of property, money, precious metal, IOU, equity shares or bonds, stored in a digital, verifiable and exchangeable form, as defined by any blockchain ledger or a smart contract protocol, is described as Digital Asset. For legal point of view, as of today, all G-30 countries have evolved laws for this/ such definition.

How does this connect to relevant developments in Pakistan?

Pakistan currently does not have any regulations. It is believed that the relevant regulators, i.e. the Central Bank, Securities & Exchange Commission (SEC), and the Ministry of Finance (MOF), are working on some projects, reportedly funded by US AID.

In this context the SBP announced to deploy the blockchain technology within area of remittances from Malaysia, but cryptocurrencies are not allowed, and non-financial applications are encouraged. This, however contradictory statement, suggests forming an expert consultation group to facilitate productive action in this direction.

Policy drafts on Financial Inclusion through Digital Methods, discussed at MOF, also suffer from several technical shortfalls to inhibit categorization as addressing Fintech requirements. The expert-group could facilitate.

Additionally, it is suggested that all regulatory stakeholders, i.e. legal, technology and a few others must be looped into the development of such projects so that the resulting regulation and implementation plans are concerted and integrated.

In case of nonsynchronous and silo-based regulation / policies implemented, we risk losing our already weak financial competitive position, an existing decline in foreign remittances and may further induce capital outflows through foreign apps using such technologies. Another major area to attend to, is ensuring the security of such financial and non-financial information that is encrypted. So, we need digital encryption and data security / privacy regulations at commercial and defence levels.

From public stand point, there is a stated ban on using foreign cryptos. The process to implement such a ban is however not clear. The ground level information from the market, indicates a relatively large flow (mostly out-flow) of transactions on regular basis.

Further, a notification from SEC ( indicates that there is no legal framework other than public dissuasion from using blockchain based applications. The PTCL has secured some workshops on IBM & Microsoft sponsored platforms for blockchains and smart contracts, but purely from technical perspectives.

The above three elements combined we have decided to stay away from a global financial transformation and exclude from a multibillion-dollar industry. The faster we adapt; the more chances are for us to benefit from the ecosystem and resulting technology evolution.

Within the private sector, however, there are a few examples of its application and usage. Mostly within the financial sector but without mentioning the technology or under the umbrella of digital economy.

To conclude, Pakistan dearly needs to adopt sustainable and intelligent blockchain technologies incubation and accelerators. A supportive regulatory environment for Fin-tech, Reg-tech and Gov-tech will strengthen investor confidence, enable real-time governance and risk management oversight as well as enable technology applications that help a transparent delivery of all long term infrastructure projects, including Healthcare, education, social-care, economic zones, ports, hydro dams, and CPEC related enabling infrastructure, not to mention the added employment creation and our ability to retain local financial resources for a prosperous Pakistan.

Najeeb Zaidi is an investment-banking, risk management and financial technologies professional, with twenty-five years’ experience. He specialises in artificial intelligence, quantum computing and other emerging technologies.